Stonewell Bookkeeping for Beginners

Table of ContentsThe smart Trick of Stonewell Bookkeeping That Nobody is DiscussingThe Ultimate Guide To Stonewell BookkeepingIndicators on Stonewell Bookkeeping You Should KnowThings about Stonewell BookkeepingExcitement About Stonewell Bookkeeping

Here, we address the concern, just how does accounting assist a business? In a feeling, audit books stand for a photo in time, however only if they are updated frequently.

It can likewise fix whether to raise its very own settlement from customers or customers. None of these conclusions are made in a vacuum as accurate numeric info need to strengthen the financial choices of every little company. Such information is put together via bookkeeping. Without an intimate expertise of the characteristics of your cash flow, every slow-paying customer, and quick-invoicing creditor, comes to be an occasion for stress and anxiety, and it can be a tedious and dull task.

You recognize the funds that are readily available and where they fall short. The news is not always good, however at least you know it.

Stonewell Bookkeeping Fundamentals Explained

The puzzle of deductions, credit ratings, exceptions, schedules, and, naturally, penalties, is sufficient to just give up to the internal revenue service, without a body of well-organized documentation to sustain your claims. This is why a committed accountant is vital to a local business and is worth his/her king's ransom.

Those philanthropic contributions are all enumerated and come with by information on the charity and its settlement information. Having this information in order and nearby allows you file your income tax return with simplicity. Remember, the federal government doesn't play around when it's time to submit tax obligations. To ensure, a service can do every little thing right and still be subject to an IRS audit, as lots of currently understand.

Your organization return makes insurance claims and representations and the audit aims at confirming them (https://www.mixcloud.com/hirestonewell/). Excellent bookkeeping is everything about linking the dots between those depictions and truth (Accounting). When auditors can comply with the info on a ledger to receipts, bank declarations, and pay stubs, to call a couple of papers, they quickly discover of the expertise and integrity of the business organization

The Buzz on Stonewell Bookkeeping

In the very same method, slipshod accounting adds to stress and anxiousness, it also blinds local business owner's to the prospective they can understand over time. Without the info to see where you are, you are hard-pressed to set a location. Just with easy to understand, in-depth, and valid data can an entrepreneur or administration team plot a training course for future success.

Entrepreneur recognize ideal whether an accountant, accountant, or both, is the right remedy. Both make essential contributions to a company, though they are not the resource same career. Whereas a bookkeeper can gather and arrange the info needed to support tax obligation prep work, an accountant is much better suited to prepare the return itself and actually analyze the revenue declaration.

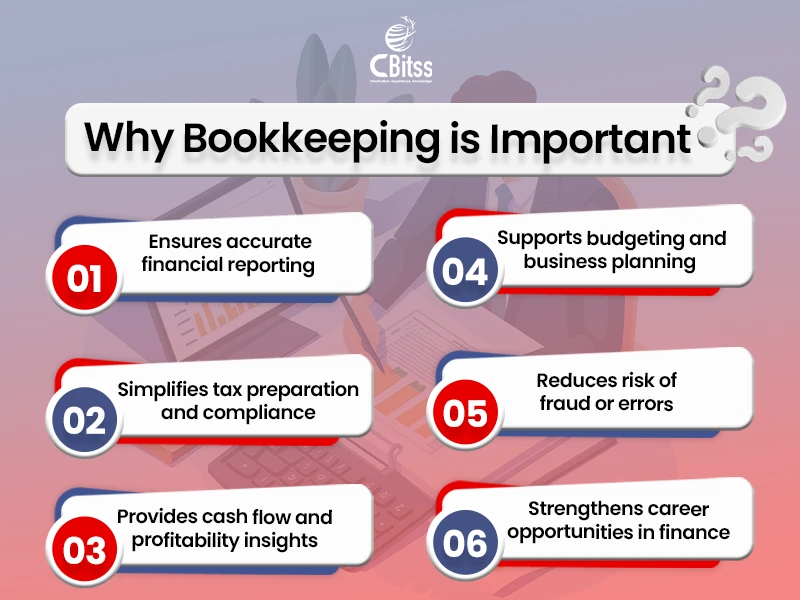

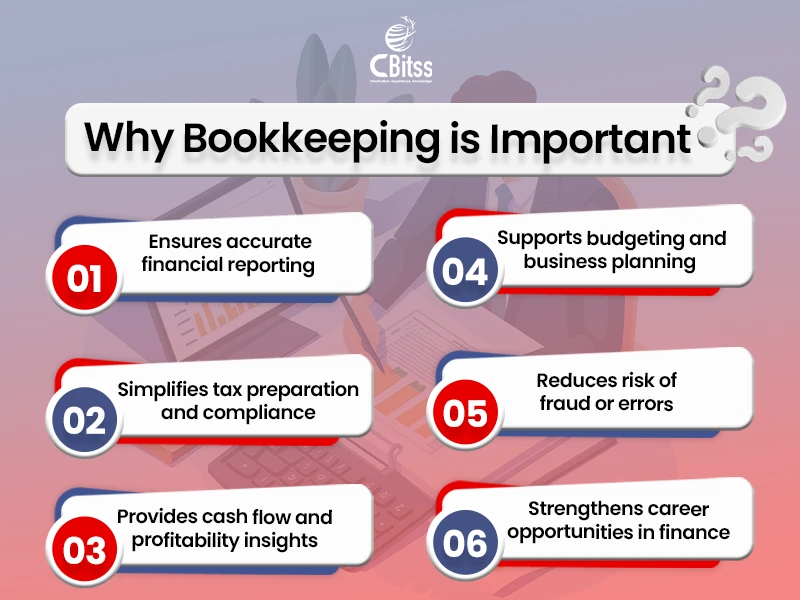

This post will explore the, consisting of the and how it can benefit your organization. We'll also cover exactly how to begin with bookkeeping for a sound financial footing. Accounting involves recording and arranging financial purchases, consisting of sales, acquisitions, settlements, and receipts. It is the process of maintaining clear and concise documents to make sure that all financial details is quickly accessible when required.

By regularly updating economic documents, bookkeeping assists companies. Having all the financial information easily accessible maintains the tax obligation authorities pleased and avoids any kind of last-minute frustration throughout tax obligation filings. Normal bookkeeping ensures properly maintained and organized records - https://hirestonewell.carrd.co/. This aids in conveniently r and conserves businesses from the anxiety of looking for documents throughout due dates (White Label Bookkeeping).

The Stonewell Bookkeeping Statements

They additionally desire to understand what possibility the business has. These facets can be easily taken care of with bookkeeping.

Therefore, bookkeeping assists to prevent the troubles connected with reporting to capitalists. By keeping a close eye on monetary records, companies can set sensible objectives and track their progression. This, subsequently, cultivates far better decision-making and faster organization development. Federal government guidelines commonly call for companies to preserve financial records. Routine accounting makes certain that services stay certified and avoid any charges or lawful problems.

Single-entry accounting is simple and works ideal for tiny businesses with few purchases. It does not track assets and responsibilities, making it much less extensive compared to double-entry accounting.

Examine This Report about Stonewell Bookkeeping

This can be daily, weekly, or monthly, depending upon your organization's dimension and the quantity of purchases. Don't think twice to look for aid from an accountant or bookkeeper if you locate managing your monetary records testing. If you are searching for a free walkthrough with the Accountancy Remedy by KPI, contact us today.